Fair credit score (VantageScore: 650 - 699 FICO: 580–669) Going over your report will reveal what's hurting your score, and guide you on what you need to do to build it. If you want to get into the "good" range, start by requesting your credit report to see if there are any errors. If you currently have a credit score below the "good" rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. Moving up to the "very good" range could mean saving more money in interest costs over the life of the debt. What a "good" credit score means for you:īorrowers with "good" credit scores will likely have a good range of credit card and loan types available to them. Lenders often call people in this category "prime" borrowers. The average VantageScore and FICO credit score for borrowers in the US falls in this range. Good credit score (VantageScore: 700 - 749 FICO: 670–739) Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

#Credit score ranges 658 how to#

How to earn a "very good" credit score:Īs with borrowers in the excellent/exceptional credit score range, borrowers labeled as "very good" by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances (what they owe) to credit limits (the amount of credit that are approved to use) is roughly 1:3 or better. How to earn an "excellent" credit score:īorrowers with credit scores in the excellent credit range likely haven't missed a payment in the past seven years. Similar to "exceptional/excellent" a "very good" credit score could earn you similar interest rates and easy approvals on most kinds of credit cards. People with excellent/exceptional credit scores are typically offered lower interest rates. What an "excellent/exceptional" credit score means for you:īorrowers with exceptional credit are likely to gain approval for almost any credit card.

#Credit score ranges 658 full#

When lenders evaluate a specific loan or credit application, they are more likely to dig into the distinct details of a borrower's full credit report and credit history before they approve or deny the application. Ultimately, lenders use a credit score range as a broad view of a borrower's credit history. Lenders can then assign appropriate interest rates, fees, and payment terms on your line of credit.

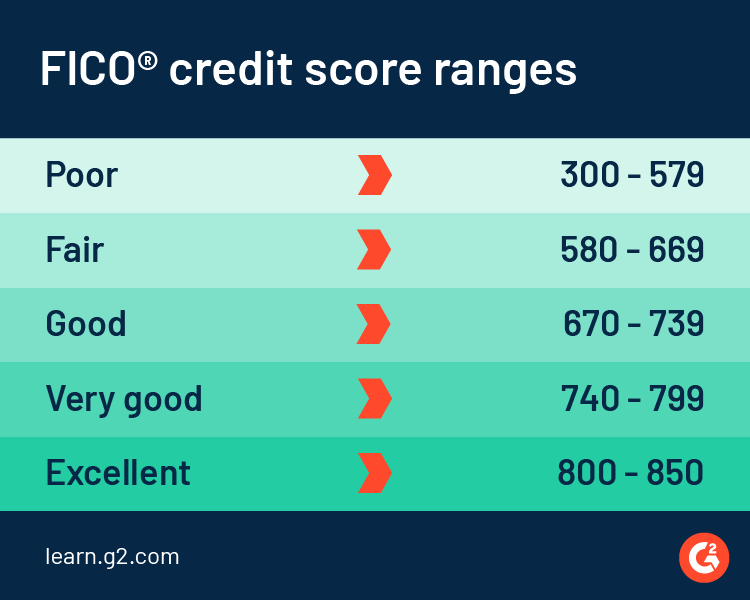

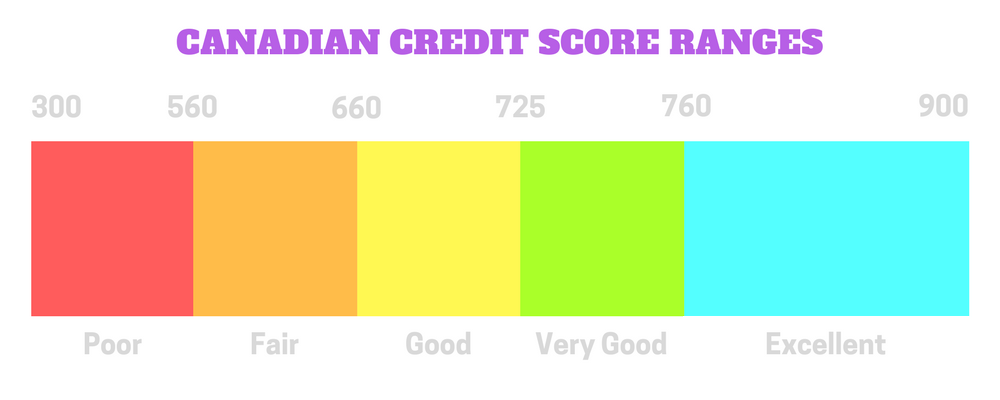

Lenders use these credit score ranges as a way to quickly, consistently and objectively evaluate your potential credit risk. They are then split into ranges, based on how low your credit score is to how high it is. What are the credit score ranges?īoth VantageScore and FICO scores span from a low of 300 to a high of 850. It's important to check your credit reports and stay updated on the factors that the agency took into consideration. Keep in mind that the algorithms for calculating scores change from time to time. The VantageScore or FICO algorithms are then applied to those reports to determine your credit score.

These three credit bureaus, Experian™, Equifax ® and TransUnion ®, collect financial information about you, like your payment history, and put them in a credit report.

#Credit score ranges 658 software#

The FICO Score - a score calculated with software from Fair Isaac Corporation (FICO) ® and used in 90% of lending decisions.The VantageScore - a competitor to FICO, created in 2006 by the three main credit bureaus.There are two main credit score calculation models in the US: By the same token, if you have late or missed payments, then your credit score will factor this in, assigning you a number that signals a higher risk of default. If your history is filled with positive behaviors like on-time payments and you've been responsible with assigned credit, then you're less likely to be seen as someone who may default on a credit card or loan. The score takes into account various factors in your financial history and behavior, especially how consistent you've been with payments on credit cards, loans and other bills. Credit scores are three digit numbers assigned to each and every one of us over 18, and are used by lenders to gauge our individual credit worthiness.

0 kommentar(er)

0 kommentar(er)